Stripe for Self-Service Payments

At Topsort, we operate a credit-based billing system where marketplaces allocate credits to vendors, allowing them to fund their advertising campaigns. Vendors use these credits to participate in auctions, and their campaigns are paused if they run out of credits, preventing further participation until they are topped up again.

At the end of each billing cycle, marketplaces are responsible for invoicing vendors directly, as this relationship is managed outside of Topsort.

Supported Billing Features:

- Marketplaces can top up vendor credits both manually and programmatically using our API.

- Marketplaces can deduct from a vendor’s balance through the API or UI.

- Ad spend history is accessible to marketplaces on the Finance Tab and via the Billing API.

- Vendors can view their transaction history on their Vendor Dashboard.

Empowering Vendor Flexibility and Marketplace Growth

Introducing Self-Service Payments, a pivotal feature designed to streamline billing processes and catalyze marketplace expansion.

Focus on enhancing vendor autonomy and marketplace efficiency for seamless operations.

- Respond to challenges of manual payments and billing complexities.

- Enable frictionless transactions and enhanced financial control.

- Tailor solutions to meet diverse needs of vendors and marketplaces.

Key Benefits

- Empower Vendors: Manage payment methods, track spending, and access billing insights.

- Simplify Processes: Facilitate seamless ad spend and campaign creation.

- Optimize Operations: Automate payment workflows, promoting transparency and efficiency.

Solution Overview

Stripe Integration: Secure and efficient method for adding payment methods and making charges. Marketplaces can see transactions directly on their Stripe accounts.

Customizable Credit Limits: Marketplaces set a credit limit for Vendors. Every time a vendor reaches the credit limit it will be charged but the campaigns will only stop after a failed charge. Credit limit adjustments apply on the next billing cycle.

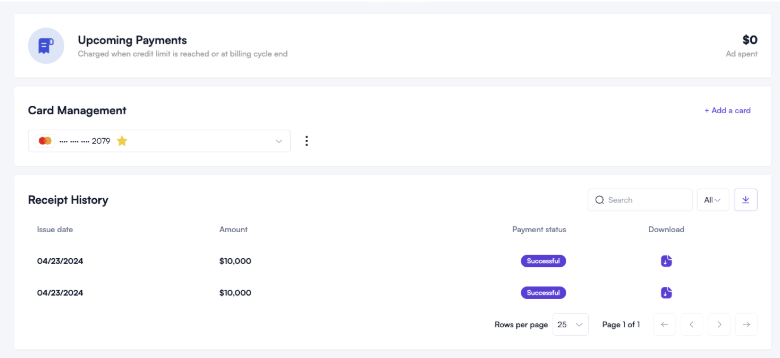

Comprehensive Reporting: Marketplaces and Vendors can see receipts, filter and download them.

Step-by-Step Guide for Marketplaces

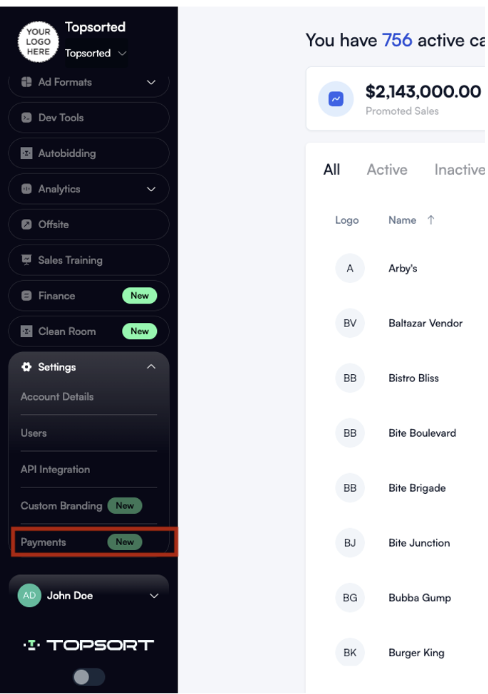

Step 1: Go to the Payments Tab: On the menu go to Settings > Payments

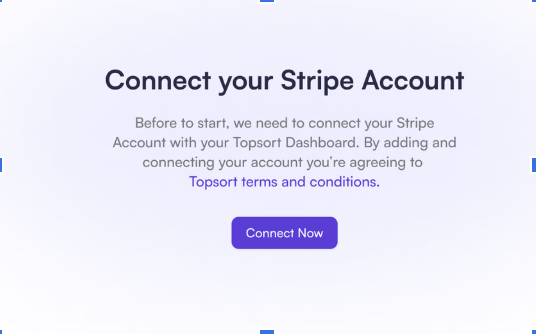

Step 2: Connect your Stripe Account: Click on Connect Now, and connect your Stripe account using Stripe integration flow

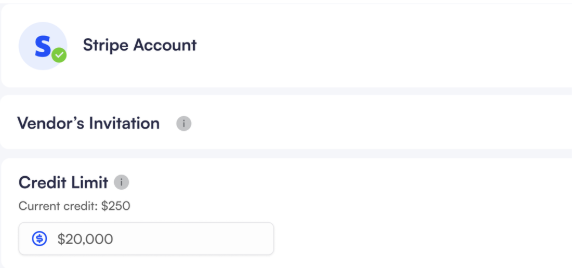

Step 3: Set Credit Limit: After you Stripe Account is connected, set a credit limit for your vendors. Vendors will be charged when they reach the credit limit or by the end of billing cycle

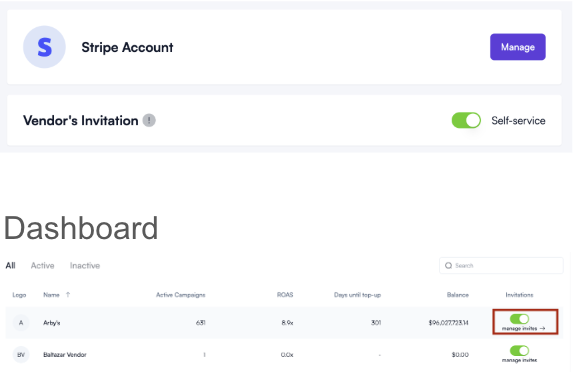

Step 4: Invite Vendors: Switch the invitation toggle to Self-Service and start inviting Vendors. Only vendors with no active campaigns and no balance will become self-service, otherwise they will stay as managed

Step-by-Step Guide for Vendors

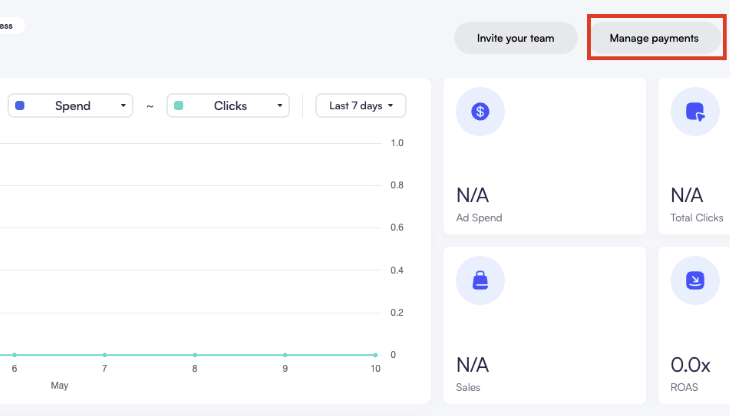

Step 1: Go to the Payments Tab: Go to the Vendor Dashboard and click on Manage Payments

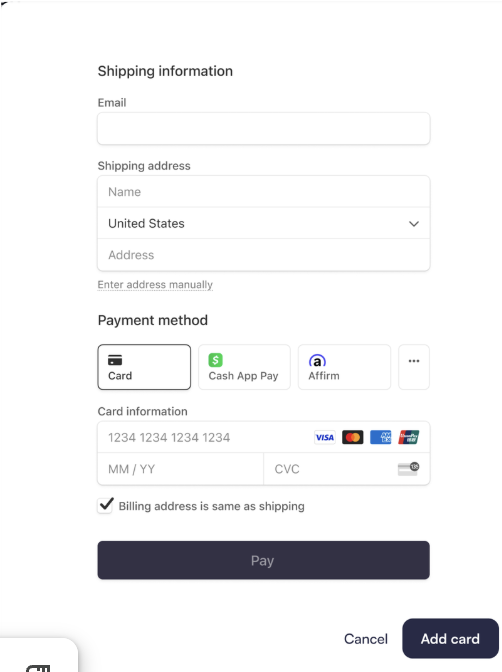

Step 2: Add Payment Method: Click on “Add a card” and add you payment method details

Step 3: Create Campaign: You can now create campaigns. You payment method will be charged when the credit limit is reached or by the end of the billing cycle

Payment Receipts and Notifications

Marketplaces will receive notifications whenever a charge is made to a vendor. They can check check and download the receipts and their history directly from the Payments Tab.

Vendors will receive notifications whenever a charge is made to a vendor. When a payment fails or is about to expire vendors will also be notified.

Also you can check and download the receipts and their history directly from the Payments Tab.